Cairo Real Estate Market Q1 2024: A Report By JLL Africa

The Cairo Real Estate Market Report for the first quarter of 2024, conducted by JLL, provides comprehensive insights into the performance and dynamics of various sectors including office, residential, retail, and hotels. With detailed analyses of supply, demand, rental rates, vacancy rates, and performance metrics, this report serves as a valuable resource for stakeholders navigating the Cairo real estate market.

Office

In Q1 2024, around 9,500 sq. m. of office space was completed with the Trivium Zayed project, contributing to Cairo’s total office stock of over 2 million sq. m. An additional 555,000 sq. m. of office space is expected by year-end, albeit with potential delays due to construction or leasing issues. The Egyptian pound experienced a significant devaluation against the USD, reaching over EGP 50 per USD from around EGP 31 previously, prompting adjustments in the sales market. Additionally, the Central Bank of Egypt’s decision to liberalize the exchange rate came with a new International Monetary Fund (IMF) agreement, increasing its loan from USD 3 billion to USD 8 billion, aiming to alleviate some of the country’s macroeconomic pressures. Despite minimal impact on the rental market, annual citywide average rents remained stable at USD 357 per sq. m. per annum, with prime rents reducing by around 6% quarterly after the devaluation, reaching USD 480 per sq. m. per annum. Q1 saw slow demand and activity. New Cairo stands out as the main business hub with more high-quality office availability compared to the west. The office sector in Cairo poised to improve in the long term, fueled by the anticipated influx of grade A office supply meeting rising demand.

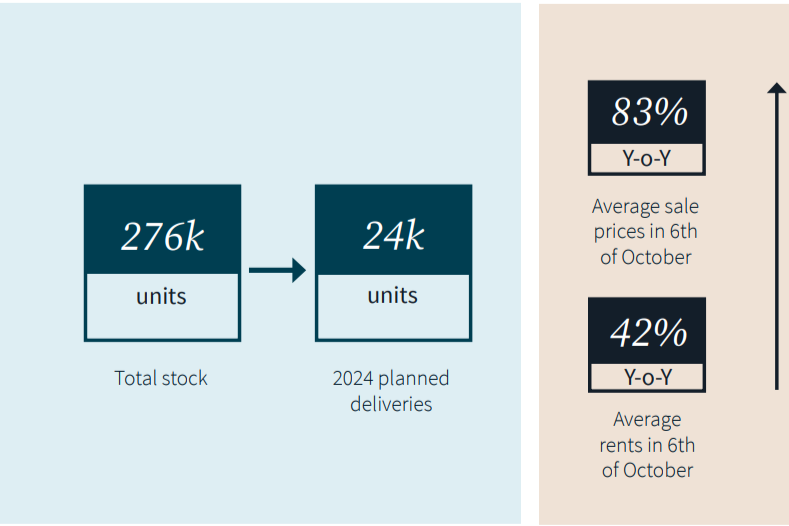

Residential

In the first quarter of 2024, the residential sector saw robust activity, with over 7,000 units completed, contributing to a total stock of approximately 276,000 units. Nearly 24,000 more units aims for completion by year-end, with a focus on New Cairo and its East expansion. The recent devaluation of the currency brought stability to the market, aiding contractors and developers in pricing strategies. However, a 600 basis point increase in interest rates and high inflation led to a more cautious approach from buyers. Sales prices surged in 6th October and New Cairo by 83% and 95% annually, respectively, while rental rates increased by approximately 42% and 43% annually, in line with inflation. Egypt secured significant FDI and support from international institutions, aiming to alleviate financial burdens and attract further investments, marking a milestone in its economic reform program.

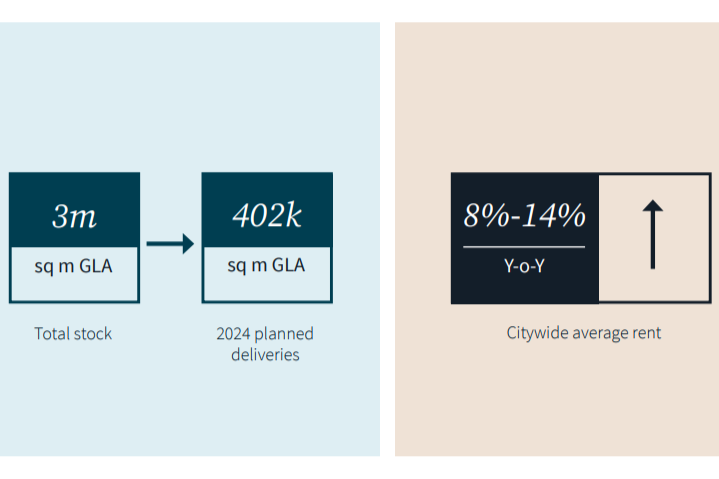

Retail

In Q1 2024, Cairo’s retail stock remained steady at around 3 million sq. m., with no major projects completed, but around 402,000 sq. m. of Gross Leasable Area (GLA) will deliver in the next nine months. According to the Cairo Real Estate Market report, economic challenges have impacted consumer spending, particularly affecting international brands, leading to exits from the market. Some landlords have implemented innovative strategies to maintain occupancy rates, such as Marakez expanding The GrEEK Campus West at Mall of Arabia. The introduction of local Egyptian brands in malls has boosted occupancy levels and sales. With the free-floating of the local currency, local production has increased, supported by marketing campaigns. Rental rates in primary and secondary malls rose by around 8% and 14% year-on-year, respectively, due to annual escalation and inflation, while the average vacancy rate slightly decreased from 9% to 8% year-on-year.

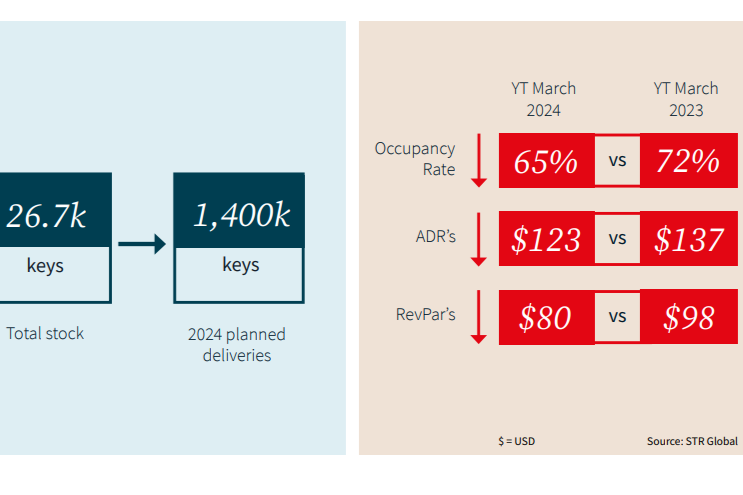

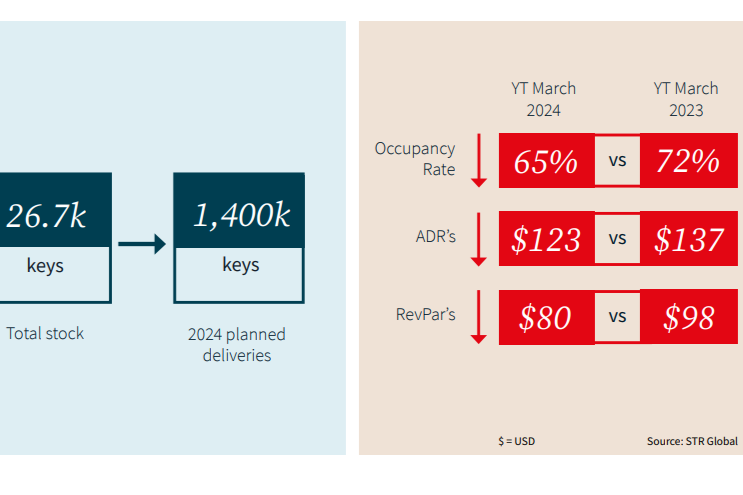

Hospitality

In Q1 2024, Cairo’s hotel stock remained stable at around 26,700 keys, with expectations of adding approximately 1,400 keys later in the year. Growing interest among operators and recent Mergers & Acquisitions, such as ADQ’s acquisition of a stake in TMG’s hospitality arm, ICON, reflect restored investor confidence in the sector. Despite subdued performance in Q1 due to currency devaluation, Egypt’s tourism momentum remains strong, with a record of almost 15 million visitors in 2023. However, occupancy rates dropped to 65%, with an average daily rate declining by 10%, resulting in a 19% decrease in revenue per available room. A new EGP 50 billion initiative aims to enhance the tourism sector by providing loan facilities and incentives for private sector participation, aligning with Egypt’s goal of expanding hotel capacity to welcome 30 million visitors by 2028. Additionally, the Ras El Hekma mega-deal with the UAE aims to further boost the sector with upcoming hospitality and entertainment projects.

JLL’s Methodology for Cairo Real Estate Market Report

JLL updates Cairo Q1 2024 future supply estimates quarterly, based on primary and secondary research, with caution regarding project completion delays. For offices, current and future supply calculations include completed GLA in specified areas, excluding owner-occupied and government buildings. Residential supply assessments cover completed units and ongoing projects in selected areas. Retail centers are classified based on GLA, with current and future supply estimates excluding street retail. Hotel supply data reflects completed rooms and ongoing projects, with updates based on primary and secondary research.

Performance Metrics

Weighted average rent (WAR) for Grade A offices is based on asking rents, reflecting rates for top-quality spaces. Vacancy rates are estimated for a selected basket of buildings. Residential performance data are based on asking prices and rents in specific areas. Retail WAR represents rents across different mall types, while vacancy rates are based on regional centers. Hotel performance metrics, including Average Daily Rates (ADR) and Revenue Per Available Room (RevPar), are obtained from STR Global’s monthly survey of midscale and upscale hotels for this report on Cairo Real Estate Market.

About JLL

JLL is a leading global commercial real estate and investment management company with a rich history spanning over 200 years. Specializing in assisting clients with various real estate needs, including buying, building, occupying, managing, and investing in commercial, industrial, hotel, residential, and retail properties, JLL operates as a Fortune 500 company with an annual revenue of $20.8 billion. With operations in over 80 countries worldwide, the company employs more than 106,000 professionals who bring the power of a global platform combined with local expertise. Driven by its purpose to shape the future of real estate for a better world, JLL is committed to helping its clients, employees, and communities see a brighter way forward. As the brand name and registered trademark of Jones Lang LaSalle Incorporated, JLL continues to set the standard in the real estate industry.

Checkout the complete report here!