Accor’s Record-Breaking Performance in 2023, Surpassing Guidance

Accor, the global hospitality leader, proudly announced its exceptional financial performance for the fiscal year 2023, showcasing robust growth and exceeding the guidance set earlier. Sébastien Bazin, Chairman and Chief Executive Officer of Accor, expressed gratitude to the dedicated teams whose commitment played a pivotal role in achieving these historic milestones.

Highlights of Accor financial Performance 2023

Accor reported remarkable financial achievements, with key indicators surpassing the 2023 guidance:

- Revenue: The Group’s consolidated revenue soared to €5,056 million, marking an 18% like-for-like (LFL) increase compared to 2022.

- EBITDA: Accor achieved a historic milestone, with EBITDA crossing the €1 billion mark for the first time, reaching €1,003 million, reflecting a substantial 49% increase.

- Net Profit Group Share: The net profit attributable to the group share surged by an impressive 57%, reaching €633 million.

Highlights of Accor’s Operational Performance 2023

Iin 2023, Accor witnessed significant growth across all regions, rebounding from the COVID challenges in 2022. Group’s confidence in sustained growth enabled them to return a total of €676 million to its shareholders in a year.

Accor opened 291 hotels, adding 41,000 rooms, resulting in a net network growth of 2.4% over the last 12 months. They boasted 821,518 rooms across 5,584 hotels, with a robust pipeline of 225,000 rooms in 1,315 hotels in 2023.

Africa and Adjacent Regions Performance

Accor has always been resilient in Africa underscoring its adaptability to diverse markets and highlight the region’s strategic importance in the Group’s global expansion efforts.

- Europe North Africa (ENA) experienced an 8% growth in Revenue Per Available Room (RevPAR).

- Middle East, Africa & Asia-Pacific reported a remarkable 19% increase in RevPAR, driven by strong business rebound in Asia.

- The Middle East and Africa, constituting 26% of the region’s room revenue, sustained robust price increases supported by consistent leisure demand, even amid the ongoing conflict in Israel.

Performance in Other Global Regions

- In France (43% of the region’s room revenue), RevPAR stabilized despite challenges in the Paris region due to the absence of major events in 2023.

- The United Kingdom (13% of room revenue) demonstrated solid and balanced RevPAR growth between London and other regions.

- Germany (14% of room revenue) experienced continued RevPAR improvement, notably during Christmas markets, but occupancy rates still lag pre-crisis levels.

- South-East Asia (29% of room revenue) achieved more RevPAR growth driven by price hike & aided by leisure demand.

- The Pacific region (26% of room revenue) is transitioning to a normalization phase with measured RevPAR growth linked to fourth-quarter occupancy rates.

- In China (19% of hotel room revenue), the recovery persisted with marked Q4 RevPAR growth surpassing 2019 levels, as seen in the third quarter.

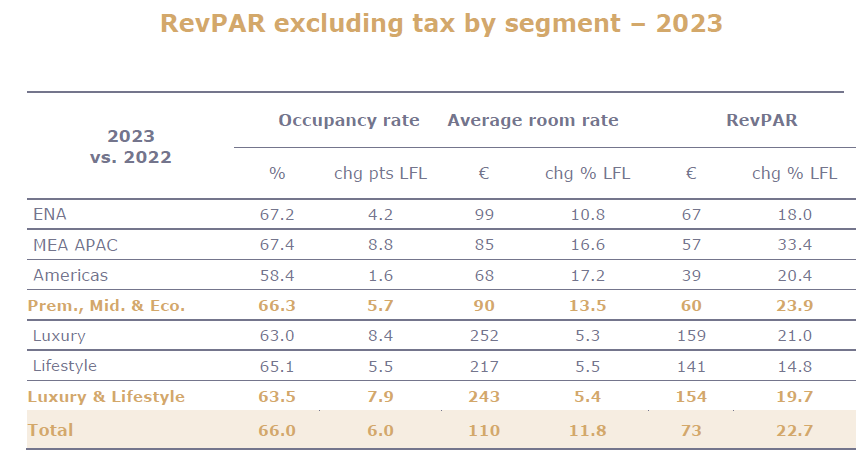

Highlights of Accor’s Divisional Performance 2023

- Premium, Midscale, and Economy (PM&E) division achieved a 12% RevPAR growth in the fourth quarter, primarily driven by price increases.

- Luxury & Lifestyle (L&L) also reported an 8% increase in RevPAR, with the Luxury segment contributing significantly to the growth.

Financial Discipline and Future Outlook

Accor’s financial success was attributed to its asset-light model, organizational efficiency, brand desirability, distribution strength, and financial discipline. Sébastien Bazin also cited that the major international events are expected to fuel continued expansion.

Accor confirmed its commitment to attractive shareholder returns, announcing a total return of €676 million during the year. The Group also reiterated its shareholder payout plan, aiming for around €3 billion over the period of 2023-2027. It includes a share buy-back program of approximately €400 million scheduled for 2024.

Accor’s initiatives in 2023 included the acquisition of Potel & Chabot, the disposal of the stake in H World Group Limited, and refinancing of its hybrid debt. Additionally, the Group announced a share buyback program. It includes the signing of a new bank credit facility for €1 billion as well as the sale of Accor Vacation Club as part of its ongoing “Asset Light” strategy.

Accor also reconfirmed its medium-term growth prospects outlining objectives for annualized RevPAR growth, network expansion, M&F revenue growth, marginally positive EBITDA contribution from Services to Owners, and recurring free cash flow conversion. The Board recommended an ordinary dividend of €1.18 per share based on the 2023 results.

Final Words

Accor’s performance in 2023, characterized by record-breaking financial results positions the Group for continued success in the evolving hospitality industry. The Group performance outlook shows its commitment to delivering value to shareholders and partners in the years to come.