Exploring Morocco’s Hotel Market: A Report By JLL Africa

The recent report on Hotel Destinations Morocco presented by JLL, offers a comprehensive analysis of the hotel destinations in Morocco, focusing on key aspects such as tourism demand, airport infrastructure, hotel supply, and investment opportunities. It delves into the recent trends, challenges, and prospects shaping the hospitality sector in the country. With a particular emphasis on major cities like Marrakech and Casablanca, the report provides insights into their respective hotel markets, including demand, supply, and future outlook.

Key Findings Of Hotel Destinations Morocco Report

Here are the key findings of the report:

1. Strong Tourism Demand Driving Market Recovery

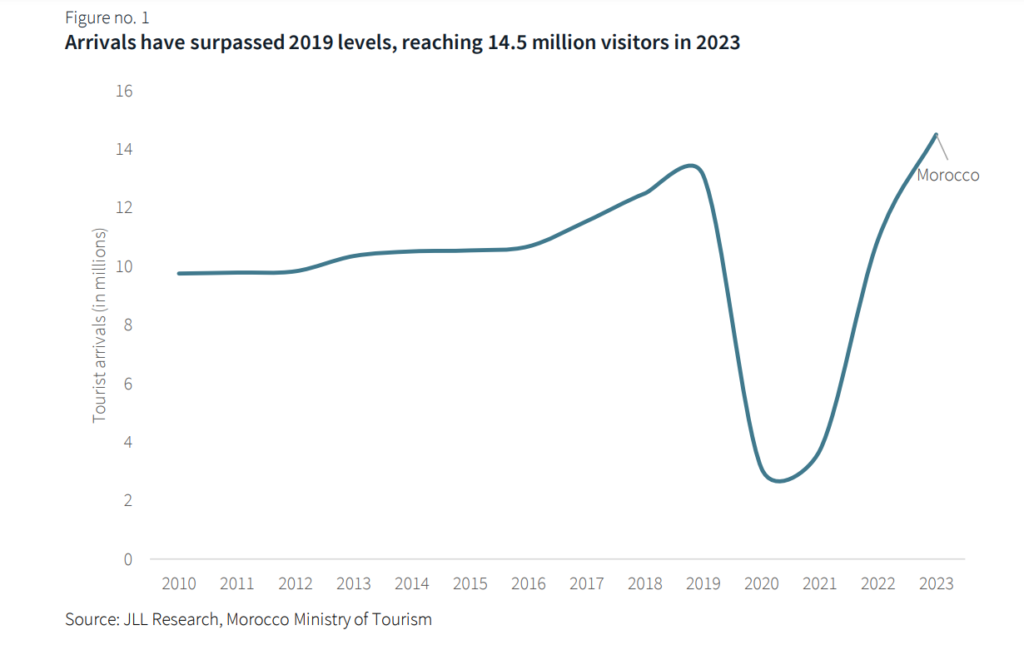

In 2022, the reopening of Morocco’s borders resulted in a significant influx of international arrivals, with over 90% of travelers originating from outside Africa. Prior to the pandemic, tourist arrivals to Morocco had steadily increased at a Compound Annual Growth Rate (CAGR) of 3.0% from 2010 to 2019. Despite facing severe impacts from the pandemic, Morocco experienced a robust rebound. By 2022 and 2023, visitor arrivals reached 11 million and 14 million, respectively, surpassing the pre-pandemic levels of 13 million in 2019. Notably, tourism contributes approximately 11% to Morocco’s Gross Domestic Product (GDP) and employs over one million people, underscoring its significant role in the economy. However, Morocco currently faces challenges, with the unemployment rate reaching a two-decade high of 13%. The tourism and hospitality sector could serve as a vital means of alleviating this economic pressure in the short term.

Additionally, the improvement of intra-African trade and visa policies is crucial for enhancing regional travel. Presently, visa restrictions pose obstacles for intra-Africa travel, with Morocco ranking 44th out of 54 countries on the African Union’s visa openness index. Approximately 45 African nationalities are required to obtain a visa before arrival in Morocco. The implementation of the African Continental Free Trade Area (AFTCA) seeks to eliminate trade barriers, thus facilitating the movement of tourists and making travel more affordable for African travelers. Successful implementation of AFTCA is anticipated to result in increased connectivity between central and southern African countries and Morocco, leading to a rise in both African travelers and airlines operating in the region.

2. Importance of Airlift and Airport Infrastructure

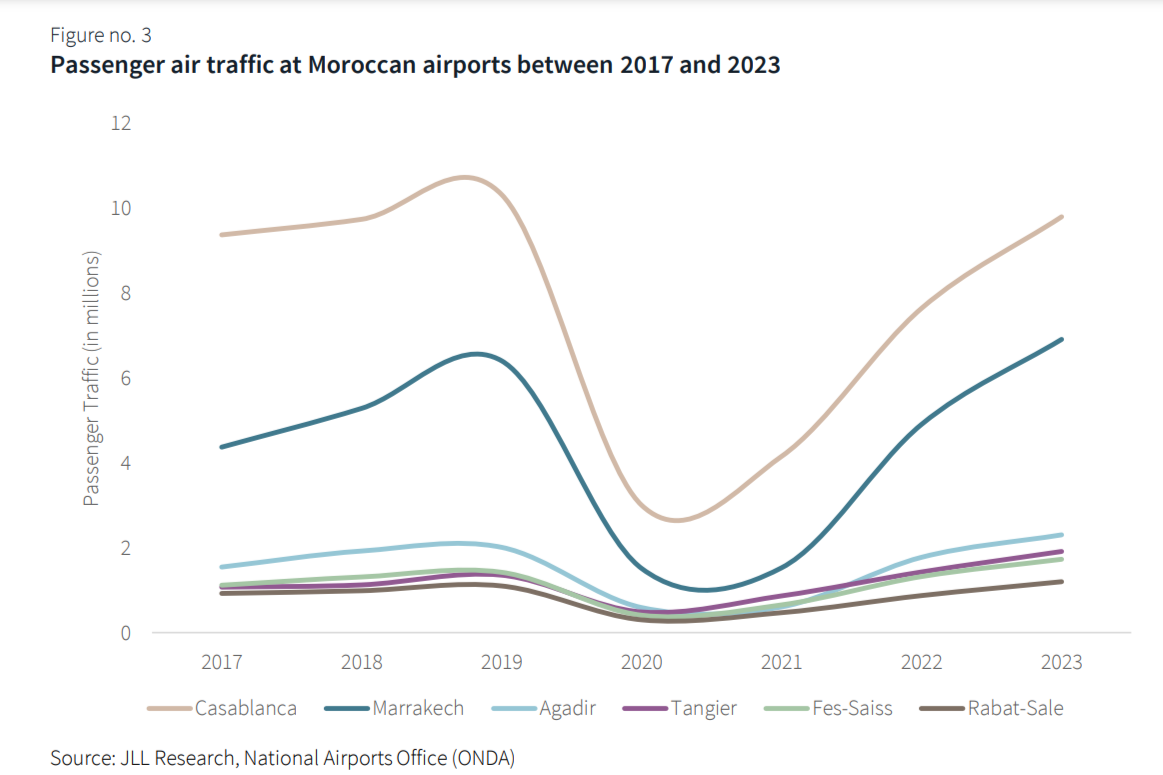

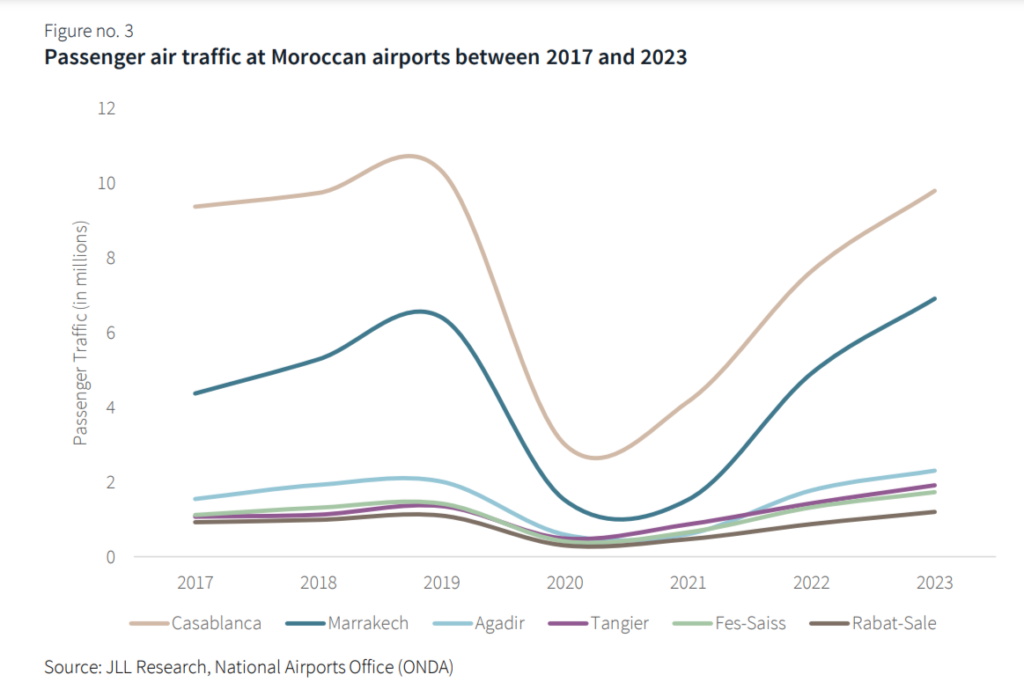

Morocco’s airports have played a pivotal role in driving tourism growth, achieving a record 27 million passengers in 2023. The reopening of borders in 2022 led to a surge in international arrivals, with over 90% originating from outside Africa. The country’s liberalized air policy has attracted more airlines, including low-cost carriers, to serve its tourism destinations. Major airports such as Casablanca and Marrakech have consistently been primary entry points for air travelers, with international travel driving the majority of passenger traffic. The addition of new airline routes, particularly by Ryanair, highlights the increasing demand for low-cost travel to Morocco.

In 2024, Ryanair is poised to expand its operations in Morocco by operating 24 international routes spanning eight European countries. Furthermore, Ryanair has secured domestic rights and plans to introduce 11 new domestic routes, linking nine cities within Morocco, including popular destinations such as Agadir, Essaouira, Marrakech, and Fes. Notably, air traffic has been predominantly driven by international travel, constituting an average of 88% of passenger traffic since 2017.

3. Increasing Hotel Supply and Investment Opportunities

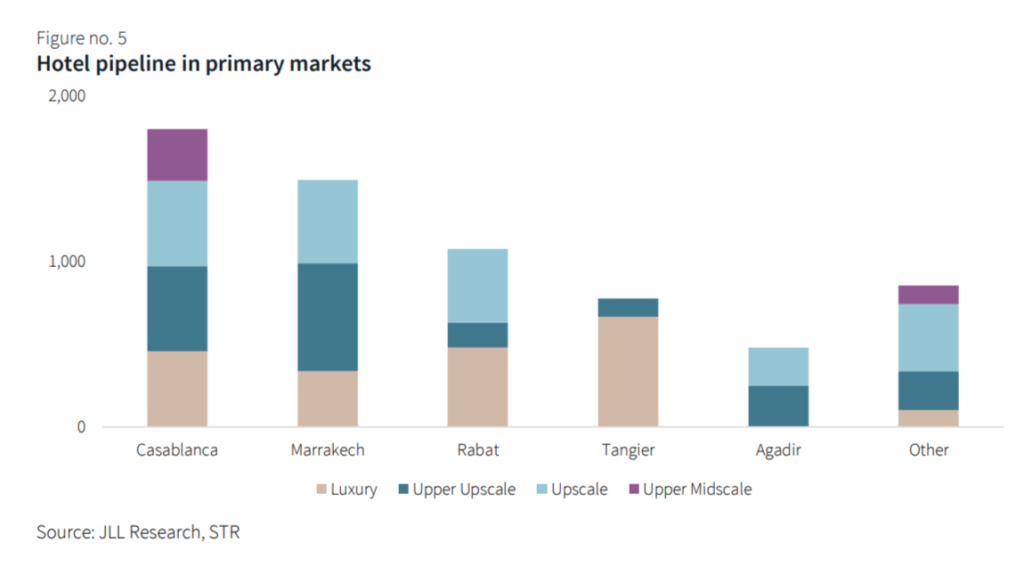

Morocco’s hotel supply ranks fourth on the continent, with over 64,000 hotel keys, predominantly concentrated in upscale segments. Marrakech, Agadir, and Casablanca account for over 65% of quality hotel supply, catering to high-volume traffic for leisure and business purposes. International brands such as Marriott, Hilton, and Accor are actively expanding their footprint in the country, with over 4,100 keys under development.

In 2023, Marrakech attracted more than 10,000 participants to the annual meetings of the International Monetary Fund and World Bank. Despite facing natural disasters, the region’s resilience serves as a testament to Morocco’s capacity to swiftly rebuild and overcome challenges.

With ambitions to double its tourist numbers by 2030, Morocco is bolstering its quality hospitality infrastructure to support this vision. Notable upcoming events include the African Cup of Nations in 2025 and the 2030 FIFA World Cup, which will be co-hosted with Spain and Portugal.

Additionally, local groups are also engaged in hotel development, with a significant portion of the hotel pipeline concentrated in primary markets like Casablanca and Marrakech. Despite challenges such as construction cost escalation, there remains a growing list of undercapitalized assets, presenting value-add opportunities for investors.

About JLL

JLL is a leading global commercial real estate and investment management company with a rich history spanning over 200 years. Specializing in assisting clients with various real estate needs, including buying, building, occupying, managing, and investing in commercial, industrial, hotel, residential, and retail properties, JLL operates as a Fortune 500 company with an annual revenue of $20.8 billion. With operations in over 80 countries worldwide, the company employs more than 106,000 professionals who bring the power of a global platform combined with local expertise. Driven by its purpose to shape the future of real estate for a better world, JLL is committed to helping its clients, employees, and communities see a brighter way forward. As the brand name and registered trademark of Jones Lang LaSalle Incorporated, JLL continues to set the standard in the real estate industry.

Checkout the complete report here!

Original Report courtesy by JLL