African Hospitality Confidence Index 2024

Africa embraces innovation in new high-growth era

The second African Hospitality Confidence Index 2024 shows a dynamic industry where most hotel, bar, and restaurant operators, along with industry suppliers, are optimistic about the future. Over 500 businesses across 30 African countries indicate recovery from the pandemic and entry into a new growth phase.

The survey reveals strong confidence in short, medium, and long-term prospects, driven by increased tourism, business travel, and the ‘bleisure’ trend. Businesses are adopting AI to boost profitability and enhance guest experiences. The African Hospitality Confidence Index 2024 reflects this positive outlook, with sophisticated strategies in place to optimize revenue and maximize occupancy. Many establishments are planning increased capital expenditure to stay competitive.

Key Facts

– 80% are positive about the sector in the medium to long-term.

– Almost 1 in 4 businesses are using Artificial Intelligence tools.

– 92% say ‘bleisure’ accounts for a significant amount of customers.

– 53% of firms use dynamic pricing to optimize revenue.

– 89% say ESG action is vital for long-term success.

– 55% have systems to foster employee satisfaction and loyalty.

SENTIMENT

- The African hotel and hospitality sector is experiencing a buoyant phase.

- 65% of respondents from 30 African countries report recovery from pandemic disruptions within expected timeframes.

- Strong confidence across the industry for current market and future outlook.

- 69% of businesses met recovery expectations, leading to improved financial performance, increased occupancy, and positive customer feedback.

- Owners and operators of hotels, lodges, bars, and restaurants are more confident than industry suppliers.

- Confidence increases over longer timeframes, supported by projected average annual growth of 8.68% for the African hotel sector.

- Statista forecasts revenue levels to reach $13.8 billion by 2027.

- Growth driven by rising global travel demand: 700 million tourists traveled internationally between January and July 2023, a 43% increase over the same period in 2022.

- Key performance indicators show strong growth: RevPAR surged to $110.70 in H1 2023, ADR jumped to $160.60.

- Macroeconomic and demographic trends drive sector growth and confidence.

- Africa forecasted to be the world’s second fastest-growing economic region in 2024, with a young, fast-growing population expected to reach 2.5 billion by 2050.

- Strong market fundamentals attract significant fresh capital, much from overseas.

- Investors view hotels as an attractive commercial real estate class due to dynamic pricing.

INNOVATION

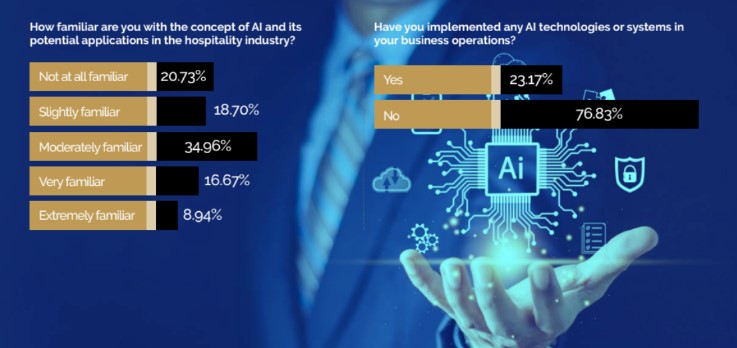

- African business leaders are adopting AI tools for a technological step change.

- Close to one-quarter of respondents are early adopters of AI applications.

- 79% of businesses are familiar with AI and its potential uses.

- 26% are very or extremely familiar with AI, signaling a determination for technological innovation.

- AI recognized for operational efficiencies, streamlined processes, cost reduction, and time-saving.

- Initial AI uses include improving customer experiences and analyzing customer behavior data.

- AI chatbots provide 24/7 assistance for routine inquiries, freeing skilled staff for value-add tasks.

- Some operators use AI in marketing to boost response rates from targeted segments.

- Large international hotel groups investing millions in AI, with small-scale pilots before mass rollout.

- Global AI spending in hospitality valued at USD 90 million in 2022, estimated to reach USD 8,120 million by 2033 with a CAGR of 60%.

- AI’s potential applications include revenue management, energy management, and security.

- Enthusiasm for AI tempered by challenges: cost and resource allocation, system integration, data privacy and security, and data quality and availability

BLEISURE

- The African hospitality industry benefits from the ‘bleisure’ travel trend, combining leisure time with business trips.

- Bleisure leads to extended stays and increased spending.

- Popular post-pandemic due to pent-up travel demand, remote working, and work-life balance focus.

- 92% of respondents note the significance of bleisure customers.

- Sector anticipates further growth in bleisure travel, with the global market expected to more than double to $731.4 billion by 2032, a CAGR of 8.9%.

- Bleisure travelers have different demands, needing accommodation that functions as both workspace and leisure space.

- Additional investment may be required to meet these needs and remain competitive.

FINANCE

Hotel and hospitality businesses use sophisticated strategies to boost revenue and increase occupancy, with dynamic pricing being the most widely used. Other strategies include upselling, special group and event pricing, seasonal pricing, and loyalty programs.

Key financial performance indicators such as RevPAR, ADR, and occupancy levels are strengthening globally, surpassing pre-pandemic levels. This positive outlook has encouraged businesses to increase capital expenditure plans. Inflation and higher interest rates remain concerns, but businesses are improving financial performance through cost controls and efficiency savings.

ESG

A large majority (89%) of businesses believe that environmental, social, and governance (ESG) initiatives are crucial for long-term success, with more than half (54%) viewing these as very important. However, ESG implementation has been slow, with fewer than half (46%) of businesses having initiatives in place. Limited knowledge of international ESG frameworks is a key stumbling block.

Businesses that have implemented ESG measures report positive impacts on customer satisfaction and loyalty. ESG priorities include using green energy, recycling, and addressing social issues like labor rights and employee welfare. Sustainable energy solutions, such as on-site solar power, are seen as beneficial for both the environment and business.

CHALLENGES

The industry faces potential challenges, including access to finance, high borrowing costs, inflation, and geopolitical risks. However, Africa is forecast to be the second fastest-growing economic region in 2024, which is a positive indicator for the African Hospitality Confidence Index 2024. Despite concerns about energy costs and supply, integrating new technology, and addressing ESG initiatives, the index suggests a resilient outlook for the hospitality sector.

Despite these challenges, the African hospitality industry remains ambitious, optimistic, and determined to embrace opportunities and overcome obstacles.

About the African Hospitality Confidence Index 2024

The African Hospitality Confidence Index 2024, compiled by Moore Global in partnership with dmg events, provides comprehensive data and insights on trends shaping Africa’s hotel and hospitality sector. This report offers a unique snapshot of an industry vital for African economies.

Demographics:

– Participants: 537 businesses from 30 African countries, including some international operators.

– Key Economies: Nigeria, Egypt, and South Africa (50% of responses from South Africa).

– Revenue: 49.5% of businesses anticipated revenues under USD 62,500 in 2023; 18% expected over USD 1.25 million.

– Ownership: 57% business owners.

– Employees: 58% have 20 or fewer employees; 21% employ over 100.

– Industry Breakdown: 66% hotel operators, 34% suppliers; hotels, lodges, and resorts make up 61%, followed by distributors/agencies (18%), food service/catering (11%), and restaurants/cafes/bars (8%).

Methodology:

– Survey Distribution: Digital distribution to hospitality and tourism databases, supplemented by digital ads and partner distribution.

– Survey Period: Conducted online between September and October 2023.

– Analysis: Moore Global tabulated and analyzed responses to produce the final report.

About Moore Global

Moore Global is a top global accounting, audit, and advisory network, ranked 11th largest worldwide by the International Accounting Bulletin. With over 34,000 professionals across 228 firms in 112 countries, Moore Global excels in advising the hotel, leisure, and tourism sectors. Their expertise includes strategic and development advisory, helping clients enhance business value and competitiveness through industry-specific insights and innovative solutions.

About dmg events

dmg events organizes over 90 dynamic trade events annually across 20 countries, attracting over 425,000 attendees in sectors like construction, hospitality, energy, and transportation. As a leading global events organizer, dmg events connects businesses with key communities, fostering growth through unforgettable experiences and trade magazines. It operates under the Daily Mail and General Trust plc.

About the Hotel & Hospitality Expo Africa

The Hotel & Hospitality Expo Africa is the premier trade event for Africa’s hotel and hospitality sector, connecting suppliers with buyers across the continent. Now in its 7th year, the expo has evolved to set the future industry trends, serving as the ultimate marketplace for the hospitality industry in the Middle East, Africa, and Asia.

About KAOUN International

KAOUN International, a subsidiary of Dubai World Trade Centre (DWTC), organizes and manages international events, creating limitless connections across various industries. Building on DWTC’s 40-year legacy, KAOUN International delivers impactful live experiences that foster business growth and economic development in sectors such as technology, food, hospitality, and sustainability.

Read the complete report here!